In today’s digital financial landscape, selecting the right trading platform is a critical first step for novice investors. With hundreds of options available — from traditional brokerages to mobile-first apps — beginners often find themselves overwhelmed by choice. According to recent data from Investopedia, the surge in retail investing has led to a proliferation of platform options, each with different fee structures, user interfaces, and educational resources.

This guide will walk you through the essential factors to consider when selecting your first trading platform, helping you avoid common pitfalls and find a solution that aligns with your investment goals.

Understanding Your Investment Goals

Before comparing platforms, it’s crucial to define what you hope to achieve through investing. Your goals will significantly influence which platform best suits your needs.

Short-Term vs. Long-Term Investing

Short-term traders seeking to capitalize on market volatility require platforms with advanced charting capabilities and real-time data. Conversely, long-term investors focused on wealth accumulation may prioritize platforms with retirement planning tools and low-cost index funds.

As financial analysts have noted, market volatility from recent geopolitical events and tariff disputes has created different environments for various investment approaches. Understanding whether you’re building a retirement portfolio or actively trading can narrow your options considerably.

Investment Types and Asset Classes

Different platforms excel at offering specific investment products:

- Stocks and ETFs: Nearly all platforms offer these, but commission structures vary

- Options and Futures: Requires specialized platforms with advanced risk management tools

- Cryptocurrency: Limited to platforms with digital asset capabilities

- Forex: Typically requires dedicated forex brokers with 24-hour trading capabilities

Recent inflation data, as reported by Investopedia, has influenced various asset classes differently, making platform specialization increasingly important for targeted investment strategies.

Key Factors in Platform Selection

Cost Structure and Transparency

While many platforms now offer commission-free trades for stocks and ETFs, hidden costs can still impact returns significantly.

| Fee Type | What to Look For | Impact on Returns |

| Trading Commissions | $0 for stocks/ETFs is standard | Direct reduction of profits |

| Account Maintenance | Monthly/annual fees | Ongoing cost regardless of activity |

| Inactivity Fees | Charged when account is dormant | Penalizes infrequent traders |

| Data Subscriptions | Real-time data costs | Essential for active traders |

| Margin Rates | Interest on borrowed funds | Significant for leveraged positions |

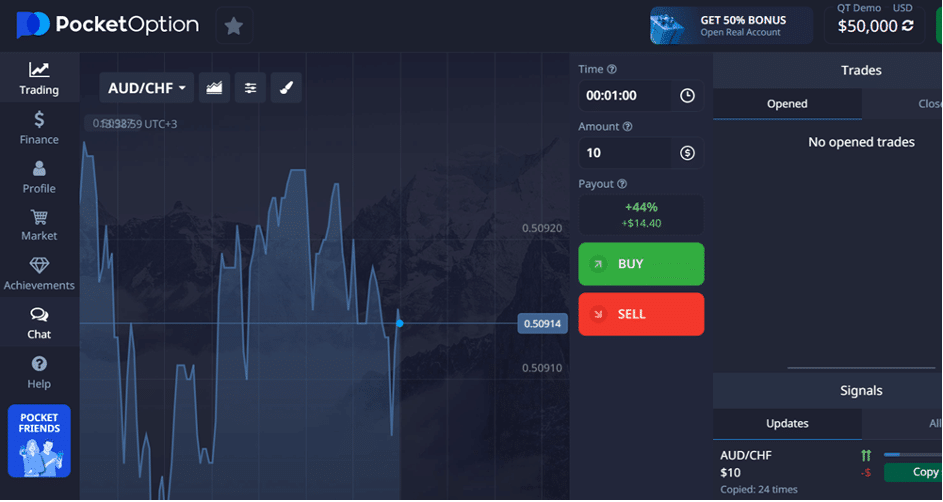

According to financial experts, beginners should prioritize platforms with simple, transparent fee structures that don’t penalize learning patterns or smaller account balances. Among these, Pocket Option has gained attention for its straightforward fee schedule that avoids the complex tiered systems found in more established brokerages.

User Experience and Interface Design

For beginners, an intuitive platform that doesn’t overwhelm with unnecessary complexity is crucial. The best platforms for novices share several characteristics:

- Clean, uncluttered interface with essential information prominently displayed

- Logical navigation that guides users through the trading process

- Mobile responsiveness for on-the-go monitoring and trading

- Customizable dashboards that grow with user expertise

- Search functionality for quickly finding investment opportunities

Poor platform design can lead to costly mistakes. A study cited by Bloomberg found that user interface issues contributed to approximately 18% of trading errors among retail investors.

Educational Resources and Research Tools

Quality educational content is particularly valuable for beginners. Leading platforms differentiate themselves through:

Learning Centers

Comprehensive educational hubs that offer structured learning paths from basic concepts to advanced strategies. Investopedia’s analysis of top brokers consistently ranks platforms with robust educational offerings higher for beginners.

Research Tools

- Fundamental analysis: Company financials, earnings reports, and analyst ratings

- Technical analysis: Chart patterns, indicators, and historical price data

- Screening tools: Filters to identify investments matching specific criteria

- News integration: Real-time financial news with potential market impact

Demo Accounts and Paper Trading

Perhaps the most valuable feature for beginners is risk-free practice through demo accounts. These simulated environments allow new traders to:

- Test trading strategies without financial risk

- Familiarize themselves with platform features

- Practice technical analysis in real market conditions

- Understand the emotional aspects of trading

- Build confidence before committing real capital

Many beginner-focused services recognize this need — for example, the demo environment at Pocket Option allows newcomers to practice with virtual funds, building confidence before transitioning to live trading.

Risk Management Capabilities

Even beginners need access to basic risk management tools:

- Stop-loss orders: Automatically sell when prices fall to specified levels

- Take-profit orders: Lock in gains at predetermined price targets

- Position sizing calculators: Help determine appropriate investment amounts

- Risk/reward analyzers: Visualize potential outcomes before trading

These features are particularly important in volatile markets, as highlighted by recent tariff-related market swings.

Customer Support Quality

When issues arise, responsive customer service becomes invaluable. Evaluate platforms based on:

- Support hours: 24/7 availability is ideal, especially for after-hours trading

- Contact methods: Phone, chat, email, and in-platform messaging

- Response times: How quickly issues are typically resolved

- Educational support: Guidance on platform features and investing concepts

Common Trading Platform Categories

Full-Service Traditional Brokerages

Established firms like Charles Schwab, Fidelity, and TD Ameritrade offer comprehensive services including:

- Wide range of investment products

- Branch locations for in-person assistance

- Robust educational resources

- Sophisticated research tools

- Advanced trading platforms for experienced users

These brokers typically rate highly in Investopedia’s annual broker reviews for their comprehensive offerings and institutional stability.

Discount Brokers

Platforms focused on cost-effectiveness through:

- Commission-free trading

- Minimal additional services

- Streamlined interfaces

- Limited research capabilities

- Self-directed investment approach

While attractive for cost-conscious beginners, these platforms may require more independent learning and research.

Mobile-First Trading Apps

New entrants designed specifically for smartphone users, offering:

- Intuitive, simplified interfaces

- Fractional share investing with low minimums

- Social trading features and community insights

- Limited but focused educational content

- Quick account setup and funding

These platforms have democratized investing but may not offer the depth required as investors grow more sophisticated.

Specialized Trading Platforms

Platforms focused on specific asset classes or trading styles:

- Cryptocurrency exchanges

- Forex trading platforms like Pocket Option that specialize in currency pairs

- Options-focused brokerages

- Active trading platforms with advanced charting

While specialized platforms are generally not recommended for absolute beginners, those with interest in specific markets might find value in Pocket Option and similar entry-level specialized platforms that balance functionality with user-friendly design.

The Danger of Complexity for Beginners

Advanced platforms like MetaTrader are powerful tools for experienced traders but present significant challenges for beginners:

- Overwhelming interface density with hundreds of indicators and tools

- Steep learning curve that can lead to frustration

- Complex order types that may result in unintended positions

- Excessive customization options that distract from fundamental learning

Financial experts advise beginners to start with simpler platforms and graduate to advanced solutions as their knowledge and confidence grow.

Finding Balance: Simplicity vs. Long-Term Viability

Ideally, beginners should select platforms that offer:

- Simplicity for immediate usability

- Growth potential as skills advance

- Comprehensive educational resources

- Reasonable costs for small portfolios

- Basic technical analysis capabilities

The trading ecosystem offered by Fidelity provides scalable solutions that grow with investor sophistication, while newer entries in the market focus on creating simplified entry points for those just starting their trading journey.

Recommendations for Absolute Beginners

For those just starting their investment journey:

Prioritize education over immediate trading – Choose platforms with robust learning resources

Start with demo accounts to practice without financial risk

Look for platforms with minimal account requirements and no inactivity fees

Ensure the platform offers basic investment types (stocks, ETFs, mutual funds)

Verify customer support is responsive and available when markets are open

Check mobile app ratings for on-the-go account management

Consider established brokerages with proven track records of financial stability

Conclusion

Selecting the right trading platform as a beginner involves balancing simplicity with growth potential, cost with functionality, and support with independence. The ideal platform should not only accommodate your current knowledge level but also facilitate your development as an investor.

Take time to research options thoroughly, test platforms through demo accounts where available, and choose a solution that aligns with your financial goals, learning style, and investment timeline. Remember that the best platform is one that you’ll actually use consistently while continuing to expand your investment knowledge.